Contents:

The tool could be used to determine the trend pivot points. MA – moving average for a period n, specified in the settings. TheStandard Deviation is a volatility indicator, measuring the rate of the price deviation from its mean value.

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

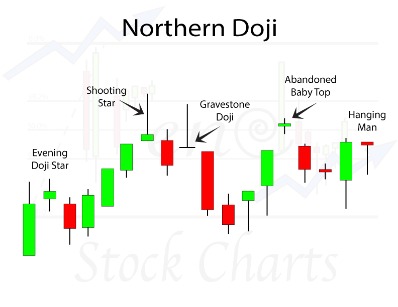

These tools help to evaluate the potential strength of the trend. These are recognizable price chart formations that often reoccur. Patterns usually signal either the continuation or the reversal of the trend. The average directional index helps traders see the trend direction as well as the strength of that trend. A trend is the general price direction of a market or asset.

How Many Types of Forex Indicators Are?

Furthermore, deposits and withdrawals are also 100% commission-free and the spreads are low too. Determining the overall trend of the market is one of the most important first steps in knowing when and where to trade. This is because once a trend is set in motion it can continue for some time before it turns.

At points 2,3, and 6, the https://g-markets.net/ are clear, and the trend reverses in all three cases. At point 5, we do not consider the signal, as the market is trading flat. Mass Indexindicator is a forecasting range oscillator, which measures the rate of change of the highest and lowest price for a period specified in the settings. The MI is most often employed in the search for exit points. The ADX is recommended to traders with a basic and above-the-basic level of knowledge of technical analysis. The indicator has multiple lines, and there are many interpretations of the signals.

Ultra Profitable FX EA Scalper – MT4 Forex Expert Advisor 2021-EXCELLENT RESULTS

The Momentum Indicator is used to identify when prices are moving up or down and how strongly. It does this by comparing the current closing price to the closing price of a specified number of periods historically. The Stochastic Oscillator was developed in 1950 by George Lane.

If the price is rising, more people will be willing to buy an asset with each new candlestick. The stronger the price fall is, the more people will be willing to sell. If the oscillator is close to highs/lows, the trend should continue in the short term. If the signal line reverses at the high/low, the trend should also reverse.

A moving average is really an easy way to identify and provide a little bit of definition to the trend. This should give you the answer of whether you’re in an uptrend or in a downtrend and how solid is that trend. Because a moving average can gauge the trend direction they are also called a trending indicator . The best trading indicator for you will depend on your trading goals.

In the original version, such tools are located under the trading chart. They show the level of the current spread, divide the chart into sessions, and display trading statistics. Pattern indicators are designed to spot the chart patterns that have already formed or just started forming and are not visible in the chart yet. These indicators can build important levels, which are not visible in the chart.

How to Use the Best Forex Volume Indicators

Here, we look at seven top tools market technicians employ, and that you should become familiar with if you plan to trade based on technical analysis. Trend indicators gained popularity with the emergence and expansion of online trading which provided traders around the world, access to technical market indicators. Thus, they have been applied to any given chat by almost all online traders. According to the example above, the price plotted a bearish breakout at the lower band of the indicator and initiated a bearish market trend.

Yet, you have also got high performing Forex indicators that are available in the market. Now using these Forex indicators are like an open book. Yes, anyone from anywhere can make use of these indicators and make good money or the massive passive income as well. This Forex trader is actually depended upon the numbers and the sequence that the indicator generally works on.

FTMO – FUNDED ACCOUNTS Scalper EA – Forex Mt4 Expert Advisor HIGH PROFITS LOW DD

The 50% forex best indicator is not technically a Fibonacci level but is considered a necessary threshold. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. Well, to be honest using an indicator won’t let you earn the maximum profits or gains.

RSI divergence occurs when the price moves in the opposite direction of the indicator. This highlights the recent trend is losing momentum and a reversal could be imminent. It’s an indicator that can be used on any timeframe. The Simple Moving Average is formed on a chart by calculating the average price of a specified number of bars or periods. The average price is usually taken from the closing price but can be adjusted to calculate from the open, high, or low.

Donchian Channel:

I would set 131.7 as a target if bears are confirmed as it’s considered the next major Support zone USDJPY will be facing. Indicators that send the most accurate and profitable signals at the right time in your trading strategy. The entry signal of the Alligator is when the indicator lines are moving apart. When the lines start meeting together, it is the exit signal.

The Keltner Channel will perform well together with the Price Actions patterns. Momentum indicators and oscillators are technical tools that measure the rate of the price change over a specified period. Such types of tools define whether the bullish or bearish volumes dominate.

UPDATE 1-Ukraine’s forex reserves slip to $28.86 bln as of March 1 – Yahoo Finance

UPDATE 1-Ukraine’s forex reserves slip to $28.86 bln as of March 1.

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

In this way, indicators can be used to generate buy and sell signals. According to the generally accepted rules, the MA 50 moving above MA 200 represents a bullish crossover of the moving averages. Conversely, the MA 200 turning above MA 50 is considered as a bearish crossover signal. Besides crossover signals, these MAs also indicate intraday and long-term dynamic support/resistance levels. MACD is an excellent indicator of price momentum, showing the direction of the stock price in the market.

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth-164×164.jpg

TheVWAP is one of the moving averages derived indicators that takes trading volumes into account when averaging prices. VWAP is the abbreviation of the volume-weighted average price. The greater the trade volume of a particular candlestick, the greater its weight in the total result. The work algorithm is similar to that of the moving averages. Momentumis a technical indicator used to measure the rate of the price change over a specific period. It is based on the idea of a sharp price rise/fall at the moment of the trend final stage.